Hurricane season may now be behind us, but for many owners of vacation homes, the battles with insurance and the lengthy rebuilding process continue. 2017’s hurricane season was the fifth most active since official records began in 1851. Of the season’s six major hurricanes, Maria, Irma, and Harvey proved especially devastating, causing millions of dollars’ worth of damage.

Previous articles have looked at the benefits of membership in a destination club as opposed to outright ownership of a vacation home. In this article, we will look at the merits of membership versus ownership, in light of dealing with damage from hurricanes and other natural disasters.

Insurance and Cost

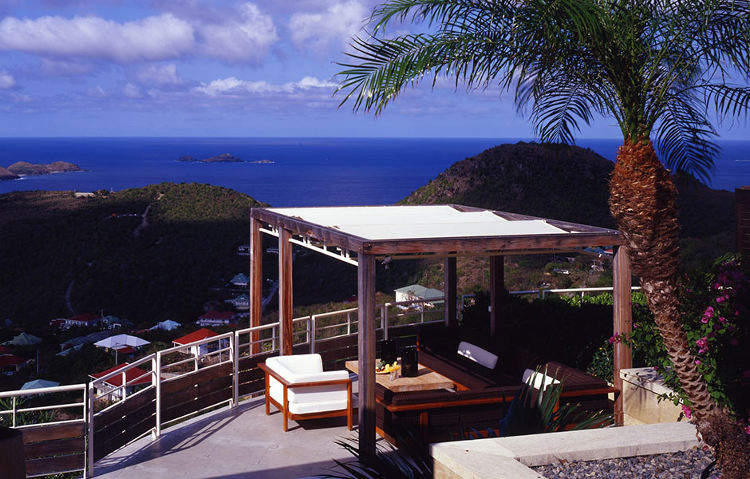

Imagine that you have bought your dream vacation home on a beautiful island, overlooking the beach and with every amenity you could hope for. Your insurance has coverage for hurricanes and so you might not be too worried about the costs incurred should one damage your property. Think again.

Deductibles are likely to range anywhere from $50,000 to $100,000, meaning that should the worst happen, you will need to find at least that much before the insurance company even thinks of paying out. In some areas, for example, the Florida Keys, it can be particularly difficult to get hurricane coverage. Those policies that are available come with large deductibles, in other words, large out-of-pocket costs for the owners.

But if you are a member of a destination club, those financial concerns need not trouble you. Kathie Waters, a Members Services Representative with the Solstice Collection, notes that any financial burden falls upon the property owners rather than club members. This is true even if you are part of an equity investment fund. John Long is Managing Director of Equity Residences. One of their funds has 100 investors. If three of their properties received serious damage from hurricanes, with an insurance deductible of $50,000 per property, that would equal a cost of $1,500 per investor. Long says that given the diversified nature of their investments, the risk is spread across the portfolio. The resulting cost per investor is minimal and may be absorbed by normal operations so that it hardly even registers on the annual profit/loss statement. The difference is significant: $1,500 per member with the option to still use other properties while repairs are underway as opposed to $50,000 and a property that is unusable.

One additional note about insurance coverage is that while policies typically cover the building and its contents, they do not cover exterior features such as landscaping. When dealing with holiday homes that may include a boat dock, a swimming pool, and an array of palm trees, replacing all of those will be an additional expense for the homeowner.

Repairs

Then comes the matter of getting the repairs done. Do you have the time to be dealing with phone calls, meetings, and site visits? Bear in mind that you, as a homeowner, will probably need to make multiple extensive trips to assess the damage to your home, to find repairmen, and to follow the progress. In addition to the time requirements, that can also be an expensive travel proposition. Once again, though, these concerns are not yours with a destination club.

To quote Waters, “They don’t have to deal with the headache if they don’t own the home.” Solstice’s property on St. Bart’s suffered some damage in 2017. Part of the roof was damaged, and the furnishings inside all had to be replaced. Waters notes that this damage was fairly minimal compared to some nearby buildings which were lost entirely. However, the repairs still need taking care of. Everyone in the area is in the same position and so everyone needs repairs. With a limited number of contractors available, repairs will take quite a while on an island such as this. What’s more, given the island’s infrastructure, everything has to be shipped from the mainland, and that can take weeks or months.

Even getting to a location to check on a property can be tricky following a natural disaster. Fortunately, with concierges or service representatives on the ground, clubs can take action more quickly. Their local knowledge and contacts can prove invaluable in getting a property back into usable shape. The Operations Director of Equity Residences was on Captiva Island to help restore a property after Irma. Within ten days, clean up was completed and power restored so that a wedding party could continue as planned.

Flexibility with Changing Plans

Both before and after a natural disaster, destination club staff are on the ball to make sure that you have an enjoyable and safe vacation. And at the first sign of trouble, they can help you to change your plans with the minimum of inconvenience.

Inspirato has its own division dedicated to risk management. Director Neil Colclough and his team carefully monitor for hurricanes, wild fires, and any crisis that might affect Inspirato members. At the first sign of a problem, they carefully track progress and make a plan of action for their staff. They use modeling programs and make sure to keep members updated. Colclough says, “We let our members know that we are monitoring the situation. The safety of our customers and staff is key.” When emergency action is necessary, they are ready to take action. For example, both Irma and Maria provided travel challenges with most commercial flights being booked as people evacuated areas in the paths of the hurricanes. The Inspirato team were able to leverage business partnerships to help get their people out, chartering boats when planes were unavailable.

In many cases, club members contact staff to cancel travel plans in the event of bad weather approaching. Club representatives will do their best to accommodate them elsewhere and this is where having a large diversified portfolio of properties comes in useful. Solstice Collection allowed members to carry unused days into 2018, and has made arrangements for access to a few other properties that are not in their usual portfolio.

An Atlanta-based investor in Equity Estates was planning a golf tournament in the Caribbean when the storms came through. He and his group relocated to a fund home in Park City, and had a phenomenal time. They are now planning to visit Park City every summer. “It was a blessing in disguise because we had such an incredible experience.” said Jon S the Equity Estates investor.

Having alternative properties and destinations is definitely a benefit of club membership. However, destination clubs are also very supportive of the local communities where their properties are based and are keen to encourage their members to visit those areas that have been hit. Waters mentions that they are encouraging members to travel to their property in Napa which was undamaged by the region’s devastating forest fires. “We want to support the local economy in its recovery,” she says.

At Equity Estates the management team received notes from investors asking what they could do to help the people who have been caring for them. Many local staff, such as the concierges and housekeepers in the Caribbean, suffered great loses, losing their cars, homes and more. Equity Estates set up a relief fund which allowed management and fund investors to directly help the people who’ve helped them over the years. Tens of thousands of dollars were raised and distributed.

As tempting as it can be to own a private holiday home, be it in a coastal resort, on a Caribbean island or in the California hills, a destination club can often provide all of the benefits without any of the headaches... or the financial risk.