One of the world’s largest private aviation companies is becoming publicly traded in a SPAC deal. Fractional jet provider Flexjet, together with its fellow brands Sentient Jet, FX Air and Private Fly will be merging with the special purpose acquisition company Horizon Acquisition Corp II (ticker: HZON). The transaction implies a pro forma enterprise value for Flexjet of approximately $3.1 billion. (Editorial update: As of 11th April 2023, Flexjet and Horizon have called off their deal and Flexjet is no longer planning to go public.)

Products & Brands

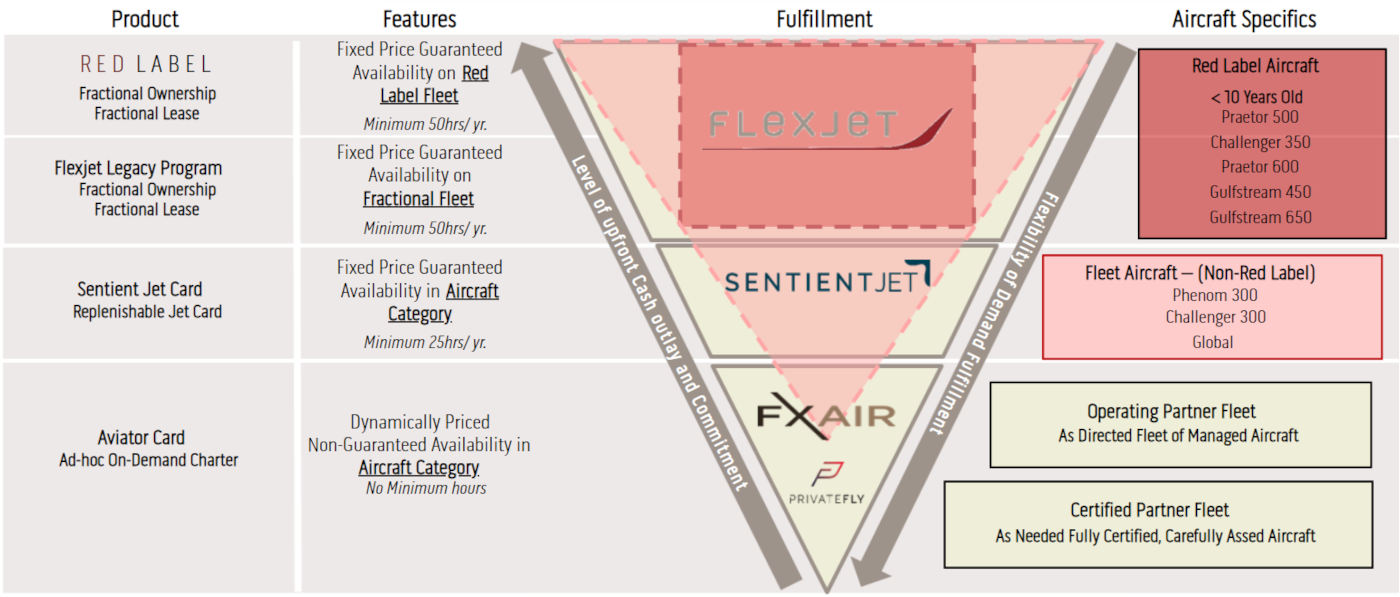

In its investor presentation related to the SPAC deal, Flexjet refers to its “Storefronts”, which are largely the different companies that it has acquired over many years, and each of which offers a particular product type, across the spectrum of aviation products. These component parts of Flexjet include:

- Flexjet - which provides jet leases and fractional jet ownership on the aircraft in the Flexjet fleet. These offerings are for clients who typically fly 50+ hours a year and want guaranteed availability.

- Sentient Jet - one of the largest jet card providers, for customers who typically fly about 25+ hours per year. Offering fixed hourly prices and guaranteed availability on 4 different jet aircraft cabin sizes.

- FX Air and Private Fly – offer on demand charter, which is market/dynamically priced with no guaranteed availability.

- Halo – a helicopter (“vertical lift”) provider

Aircraft Fleet & Pilots

Flexjet expects to have over 235 jets in its fractional fleet by the end of 2022. These will include:

- 49 Light Jets (eg Phenom 300)

- 44 Mid-Size (eg Praetor 500)

- 92 Super-Mids (eg Challenger 300/350/3500)

- 32 Large (eg Gulfstream G450)

- 18 Long Range (eg Gulfstream G650)

In addition, it has 19 helicopters and has a further 17 aircraft for which it has guaranteed exclusive dedicated capacity. For its jet card and on demand charter programs there are an additional 1,700 certified partner aircraft that are available as needed.

The fractional fleet is further split into the newer “Red Label” aircraft which are purely dedicated to fractional customers and the somewhat older “Non-Red Label” which may also be used by the customers for the other company brands eg for jet card and on-demand charter flights. The chart below shows how the fleet is used across each of the Flexjet products.

The company’s pilot operating model referred to as “Dedicated Crewing” is one that assigns pilots to one specific airplane N-number. Flexjet says this model provides an extremely comfortable and safe environment for the company’s flight crews and the familiarity with their aircraft increases dispatch reliability over similar aircraft not flown with dedicated crews. In conjunction with its dedicated crews, Flexjet has made a commitment to maintaining the highest compensation among its pilot peer group as well as attractive work rules. The aim is to make Flexjet an employer of choice and reduce pilot attrition during an extremely competitive pilot hiring environment. Flexjet’s average pilot new hire has more than twice the flight hour minimum required for application and 36% of their pilots have been with the Company for more than 15 years. The company has 1,000 pilots out of its total 3,100 employees.

Revenue Numbers

Flexjet is forecasting revenue of $2,296m for 2022, and what it calls management adjusted EBITDA of $288m. In discussing the revenue, the company says “This subscription-based recurring revenue comes from a large, committed customer base of ultra-high-net-worth individuals and Fortune 500 corporations through approximately 10,000 committed contracts.” In this case the “committed contracts” are fractional shares and leases and jet cards.

It goes on to say that it has a 97% customer retention rate (for Flexjet US customers) and over 35% of Flexjet’s fractional customers have been with the company for more than 10 years and 55% have been with the company for more than five years.

Growth & Expansion

As might expect in a public filing document, Flexjet talks about the opportunities it sees for growth. These include geographic and program expansion, including growth of the fractional lease program, investment in the large cabin fleet and infrastructure expansion, including growing the number of private terminals.

As part of the SPAC deal it expects to add about $175m in cash to its balance sheet.

“Having capital and currency will position us to expand market share at an accelerated pace in an opportunistic environment,” said Kenneth Ricci, Chairman of Flexjet.

Private Aviation Market

There is certainly ongoing consolidation in the private aviation market and if you are a regular reader of SherpaReport you will have read about the major acquisitions and expansions of the leading operators. Just last year Wheels Up, another major player, also went public via a SPAC deal. Vista Global Holdings has been acquiring multiple companies over the last few years. The newer operator flyExclusive has been growing organically. And all of these companies are chasing market leader NetJets.

In terms of 2021 flight hours market share for US registered aircraft, Flexjet says it breaks down as:

- NetJets 25.0%

- Flexjet 14.4%

- Vista Global 6.5%

- Wheels Up 5.9%

- flyExclusive 2.9%

- Others 45.6%

The above shares are for fractional, branded charter and aircraft management operators, and the Wheels Up data excludes its turbo-prop numbers (so are jet only).

Looking at the broader US private aviation market of charter, fractional ownership and whole ownership, Flexjet says this is a $33bn market. It considers that there is also "significant potential" to capture some of the business and first class commercial market, which it says is about $373bn per year, and quotes a McKinsey report from 2020 which "Estimated 90% of people who can afford to fly privately don't."

Timing

The SPAC merger transaction, making Flexjet a publicly listed company, is expected to be completed in the second quarter of 2023. Upon the closing of the transaction, Flexjet is expected to be listed on the NYSE under the ticker symbol “FXJ”.

(Editorial update, as noted above: As of 11th April 2023, Flexjet and Horizon have called off their planned merger and Flexjet is no longer planning to go public.)