The data from August and early September show further increases in business and private aviation. In contrast, commercial aviation continues to struggle.

Increase from July

According to flight data from ARGUS, the overall increase in private flights was 1.8% in August when compared to July 2020. Their breakdown of month-over-month activity by aircraft type and operational type shows:

| Part 91 | Part 135 | Fractional | All | |

| Turbo Prop | -0.3% | -2.4% | -3.8% | -1.3% |

| Light Jet | 1.4% | 0.5% | 6.9% | 1.8% |

| Mid-Size Jet | 1.3% | 2.2% | 6.5% | 3.1% |

| Large Jet | 6.9% | 8.1% | 9.8% | 7.6% |

| All Aircraft | 1.5% | 0.8% | 5.9% | 1.8% |

As you can see in the table, fractional flights grew the most with an overall 5.9% increase between July and August. Growth in part 135 (charter flights) and part 91 (general aviation private flights) was smaller.

Looking back a year, ARGUS says that overall private and business aviation flights were still down about 21% from August 2019. Although within this mix fractional and charter were both down about 16% from the prior year and part 91 was down 25%.

Continues in September

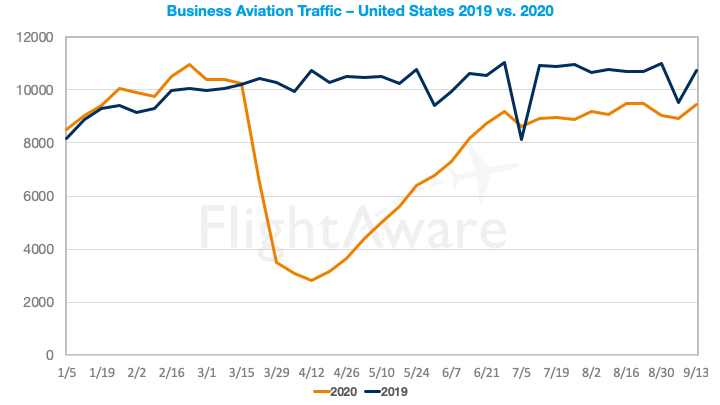

Flight tracking data provider FlightAware has released it own graph showing business and private aviation flight activity into September 2020 for the United States. This shows continuing growth. FlightAware says that based on the latest weekly average, these flights are just 11.9% below 2019 levels.

At the start of the pandemic demand for private flights dropped significantly, with a low point in April. But since then a lot of the demand has returned, including a lot of people who are new to private aviation, as customers recognize the advantages it offers during a health crisis.

Pricing Firms Up

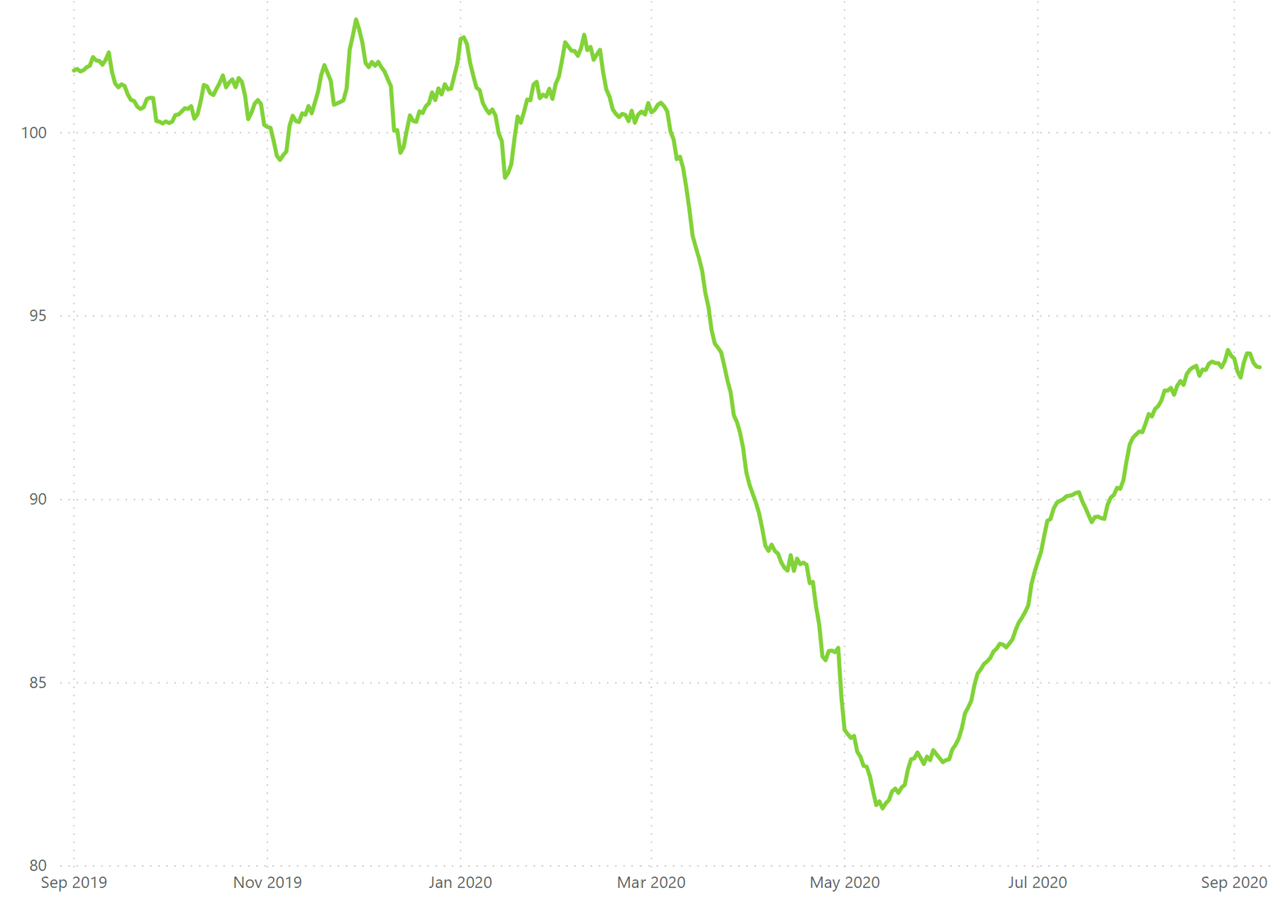

The increasing demand for private flights is also reflected in the latest hourly charter rates. For instance, the graph below is the rolling 14 day pricing index, based on hourly quote rates for light jets, for US domestic travel. This graph is courtesy of Avinode based on data in their charter marketplace.

Harry Clarke, Head of Insight & Analytics at Avinode said "Pricing has stabilized in the last few days, about 5-7% down on where it was pre-COVID," and added "trends are similar for other (aircraft) categories."

Commercial Aviation Still Down

The above private aviation activity data is in stark contrast to the commercial sector. According to Airlines for America, (formerly the Air Transport Association of America), an American trade association and lobbying group, the latest US airlines passenger volumes are 65% below a year ago levels. With the latest stats showing domestic is down 63% and international down 84%. The number of actual flights is down about 50%. Airlines for America notes this is “driven largely by an evaporation of business travel.”

SherpaReport has talked to several private aviation companies over the last few weeks, and a broad recurring theme has been the growth in private aviation is due largely to leisure travelers. So both private aviation and commercial aviation are waiting for the full return of business customers.