As 2022 draws to an end, aviation companies are once again releasing their industry forecasts for sales of new business aircraft. We look at insights from manufacturer Honeywell and analysts at JETNET iQ to see how ongoing economic, social, and political factors may play a part in the market for new business jets.

The Ten Year Forecats

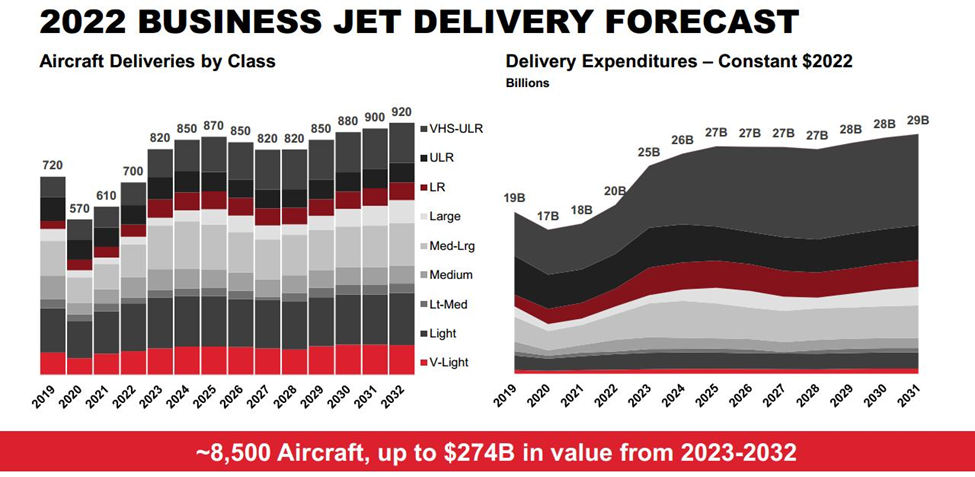

The industry experts are optimistic about a strong market. They predict between 8,400 and 8,500 new business jet deliveries between 2022 and 2031. That amounts to an estimated total dollar value of $264 bn to $274 bn.

The covid pandemic saw demand for both new and pre-owned jets climb to record levels. In a JETNET iQ survey of owners and operators in the private aviation sector, 58% responded that they expected demand to increase even further over the next 5 years.

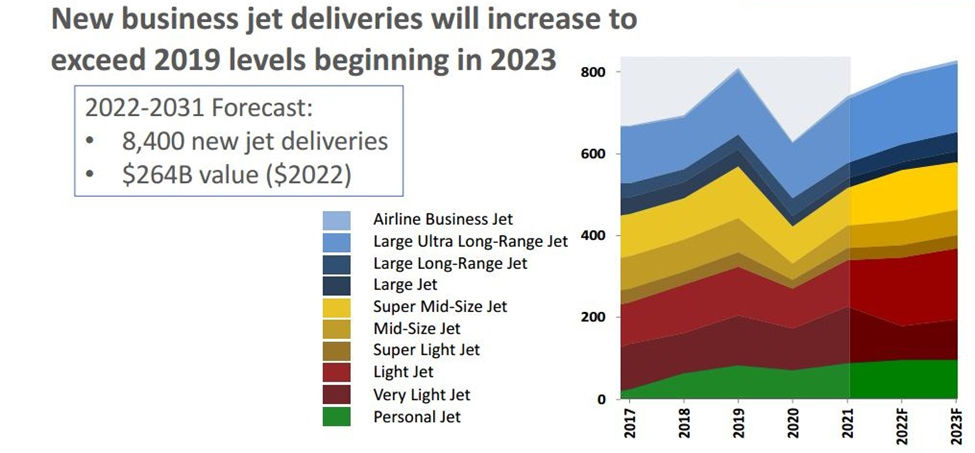

The JETNET iQ forecasts predict 8,400 new jet deliveries, worth $264 bn over the ten year period, 2022-2031. The first few years are shown in the chart show:

As in previous years, there is heavy demand in the smaller light and very light jet categories and also in the category of large ultra long-range jets.

According to Honeywell’s business jet forecast, large cabin jets will account for 38% of new units delivered, and 71% of the total dollar value of all new units, as shown in the chart below:

First-Time Users

Heath Patrick, Honeywell Aerospace President, Americas Aftermarket had this to say about the forecasts:

“The business aviation industry is greatly benefitting from a wave of first-time users and buyers, due in part to changing habits brought on by the COVID-19 pandemic. The business aviation sector is expected to recover to 2019 delivery and expenditure levels by 2023, which is much sooner than previously anticipated. Demand for new business jets is as high as we’ve seen it since 2015, and we expect high levels of demand and expenditures for new aircraft for several more years.”

Both Honeywell and JETNET iQ experts agree that the market is looking positive. This year, Honeywell sampled first-time aircraft owners to learn more about those who are new to business aviation. Their current long-term predictions reflect a 15% increase in units delivered compared to just one year ago. The pandemic saw many first-time buyers and flyers in the private aviation market, and roughly three-quarters of those newcomers say that they will continue to fly as much in 2023 as they did this year.

Among other findings about new private aviation flyers:

- Nearly 74% of surveyed new users of private aviation expect to keep the same level of flying in 2023 as they did in 2022, which is 10 percentage points above the whole fleet average. Only 4% expect to fly less in 2023.

- Nearly 85% of first-time users operate in the Americas.

- Within the Americas, 80% of first-time buyers operate in the United States; the rest mostly operate in Brazil.

- Business turboprops and small cabin jets each make up 35% of the fleet carrying these new users, followed by medium jets (18%) and large long-range jets.

New Order Backlogs

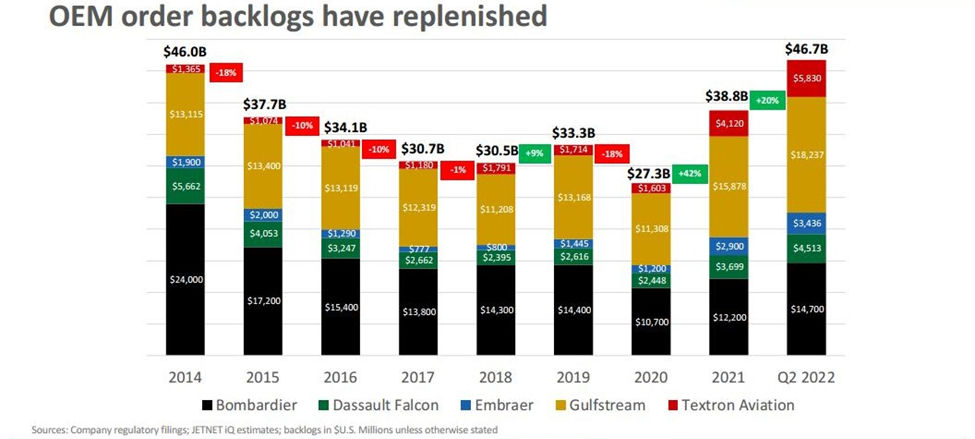

The new order books with the big five (Original Equipment Makers) OEMs currently hold a combined value of over $46 bn, according to figures from JETNET iQ, a figure that translates to about 2 years’ worth of orders. This means that anyone placing an order for a new aircraft with Bombardier, Dassault. Embraer, Gulfstream, or Textron will have a wait of two years or so until they can take delivery. Overall, new jet deliveries and expenditures are expected to grow by approximately 2% each year in the coming decade. The JETNET order book figures are shown in the chart below:

Increasing Demand for Sustainability

In other news, Honeywell reports a continued interest in environmentally friendly operations. Many aviation companies are already exploring ways to be more environmentally friendly, whether that be through the purchase of carbon credits, greener on-ground technologies, or the use of sustainable aviation fuel (SAF). Half of all operators have implemented at least one method to reduce their carbon footprint. Among those surveyed by Honeywell, increasing passenger capacity and fewer/slower trips are the most common methods currently adopted. The use of SAF is being widely explored as a way of being more eco-friendly, although limited availability is a hurdle.

As for global markets, Honeywell’s findings indicate that the North American market is where demand for new aircraft is strongest, accounting for 64% of the overall demand. Europe comes in at a distant second (15%) with Asia/Pacific, Latin America, and Africa/Middle East at much smaller shares.