The recent numbers from across the market show continuing high demand for pre-owned business aircraft. General demand, including new buyers, plus the 100% bonus depreciation, which ends this year, is keeping the market very active as 2022 closes out. Prices are generally at historically high levels.

JetNetiQ

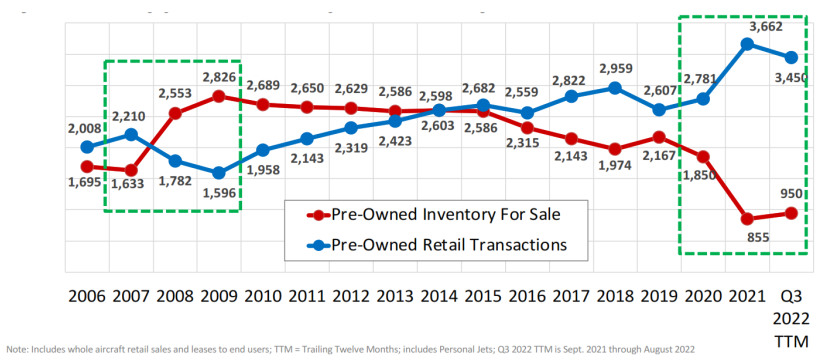

Research from JetNetiQ shows the high number of used aircraft sales transactions and the low number of aircraft available for sale. The chart below clearly displays the high number of sales (the blue line) over the last two years, when compared to the prior 15 years.

Although JetNet did note, and the chart above shows, that pre-owned aircraft available for sale (the red line) has begun to increase after record lows. In particular at September 2022 the number of personal jets on the market had increased quite a bit to 7.6% of aircraft for sale as a % of the total fleet. For other aircraft sizes the figures were lower in the range of 2.3% to 5.5% of the available fleet on the market. In a “normal” market the number of aircraft available for sale is in the 10% to 12% range.

Jetcraft

In their latest “Pre-Owned Business Jet Market Forecast”, covering 2022-2026, the brokers and advisors at Jetcraft say, ”Shifts in buyer behavior continue to fuel this upward trajectory with more and younger first-time buyers entering the market, greater demand for larger jets and a growing UHNWI population.”

The Jetcraft report has the average purchase price of a used jet at $7.8m in 2022, which is the highest level since 2012, but well below the bubble pricing $10m to $11m in 2007-2008.

AMSTAT

The analysts at AMSTAT note that in the first three quarters of 2022 “Robust demand and low availability continue to push values up with the Heavy Jet median value up 19% YTD and the Super-Mid median value up 31% year-to-date.”

Transaction activity in the medium and light jet segments remains ahead of historical norms but is lower for the first three quarters of 2022 than the same period in 2021 by 18%. However, for comparison, the transaction count for the medium jet segment is 30% ahead of the same period in 2019 and 33% ahead for the light jet segment.

On the value front, over the last 12 months, the median value of medium jets has risen 35%. And is up 23% YTD after dropping mid-year. For light jets the median value has risen 46% over the last 12 months. This metric is up 25% YTD but is largely unchanged since July. For turboprops the median value has risen 46% over the last 12 months and is up 12% since the since the start of 2022.

IADA

The International Aircraft Dealers Association (IADA) released their Q3 Market Report at NBAA-BACE. IADA is a professional trade association who’s member dealers annually average over 1,100 transactions and $10 billion in volume.

“The collective sentiment of IADA members is that traditionally heavy fourth quarter volume will be driven by the phase-out of 100 percent bonus depreciation in the U.S., airline cutbacks to smaller cities spurring first-time buyers, and cash availability for most aircraft purchases,” said IADA Chair Zipporah Marmor.

The third quarter survey responses from IADA membership show a slight increase in supply while demand remains stable for the next six months in the markets for turboprops and light, mid-size, and ultra-long-range jets.

“We expect to have an extremely robust Q4” said Wayne Starling, Executive Director of IADA, but added that 2022 may not exceed 2021 because of “a lack of inventory” and a “lack of parts, which means planes may not pass pre-buy inspections.”

“The supply-demand has been driven by things like our members reporting 40-50 percent of transactions in 2021 were first time buyers. This is really unprecedented historically,” said IADA Vice Chair Phil Winters.

Referring to new aircraft deliveries Zipporah Marmor noted “The OEMs had to reduce production at the start of the pandemic. It’s not been increased yet due to issues with supply chains, due to issues with workforce. That’s all having an effect on our markets, on the pre-owned markets, and driving some of the demands in our markets.”

IADA also noted that with over 60 percent of transactions in cash, global buyers and sellers seem somewhat immune to rising interest rates.

The bonus depreciation, referred to above, drops to 80% in 2023 - this is still a high level - and the other 20% is also available but over a period of years. Overall, the market is very robust, with high demand, high prices and low numbers of planes for sale. Although it has slightly mellowed from the frothy levels of a few months ago.