The part 135, private aircraft charter companies saw overall flight hours bounce back significantly in 2021, after a COVID induced drop in 2020. Amongst the top 25 companies the average growth was over 50%, and several companies grew well over 60%.

Company Rankings

The table below shows the twenty five largest aircraft charter companies ranked by number of flight hours in 2021, with data from aviation services company ARGUS.

Most of the larger operators also offer jet card or membership options as well as on-demand charter. All these flights are under FAR Part 135 rules and are included in the hours below. In many cases the companies also manage additional private aircraft that the individual owners do not make available for charter These operate under FAR Part 91 (Non-Commercial Operator) and the hours are not included below.

| Operator Name | 2021 | 2020 |

| 1. Wheels Up | 166,805 | 119,478 |

| 2. Executive Jet Management | 62,681 | 37,348 |

| 3. XO Jet | 55,325 | 50,392 |

| 4. Exclusive Jets | 43,067 | 24,579 |

| 5. Jet Linx Aviation | 42,284 | 29,664 |

| 6. Solairus Aviation | 39,687 | 20,968 |

| 7. Jet Edge | 32,403 | 19,277 |

| 8. Clay Lacy Aviation | 17,940 | 10,761 |

| 9. Corporate Flight Management | 14,284 | 10,308 |

| 10. Aero Air | 13,800 | 10,508 |

| 11. Red Wing Aeroplane Co | 12,419 | 9,199 |

| 12. Worldwide Jet Charter | 11,966 | 9,702 |

| 13. Thrive Aviation | 11,936 | 7.975 |

| 14. NXT Jet | 11,737 | 3,093 |

| 15. Hop A Jet | 11,682 | 6,453 |

| 16. Jet Aviation | 11,502 | 7,493 |

| 17. Talon Air | 11,489 | 9,850 |

| 18. Jet It | 11,290 | 3,977 |

| 19. Superior Transportation Associates | 11,187 | 6,396 |

| 20. Berry Aviation | 10,982 | 6,047 |

| 21. Grandview Aviation | 10,593 | 3,914 |

| 22. Jet Access Aviation | 10,477 | 6,641 |

| 23. Scott Aviation | 10,082 | 5,998 |

| 24. Prime Jet | 9,945 | 6,141 |

| 25. SC Aviation | 9,615 | 6,208 |

In total, Part 135 charter operators flew 1,947,472 hours in 2021 which is an increase of 617,743 hours, or 46%, from 2020. As mentioned above the top 25 operators increased their hours by over 50% on average, so above the 46% for the sector as a whole and indicating the growing consolidation in this sector. Larger cabin aircraft saw the biggest return in 2021with flight numbers up 60.7% compared to 2020, and super-mids were up 52.8% over this period. Both of these categories of planes benefited from the return of longer flights and some international travel.

Monthly Trend

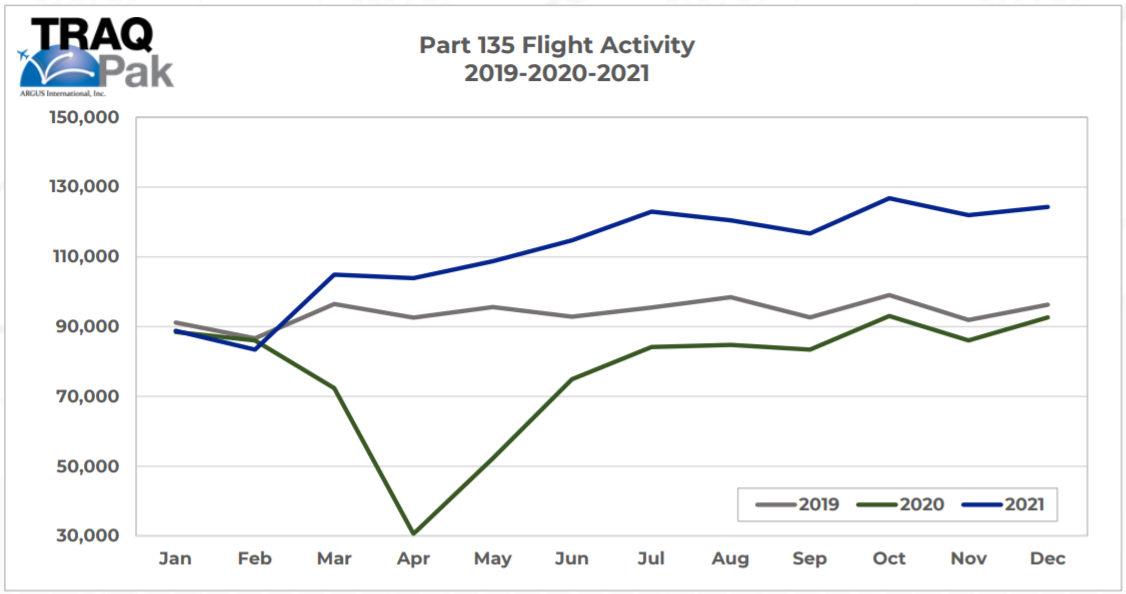

The overall charter flights by month followed a very similar pattern to that seen across other parts of private aviation, with the number of flights increasing throughout the year The graph below, courtesy of ARGUS, shows the flight activity by month compared to 2020 and 2019. The top blue trend line shows the monthly 2021 numbers.

Comments

The top 10 largest operators are essentially the same as in 2020, although there have been some changes in the ranking.

Wheels Up is by far the largest aircraft charter company, and the 2021 numbers (of 166,805 hours) reflect all the recent acquisitions. The acquisition spree has continued into 2022, when earlier this month Wheels Up bought charter operator Alante Air. The prior acquisitions included Gama Aviation Signature, which was acquired by Wheels Up in 2020, and at the time was the largest charter company. Delta Private Jets, Mountain Aviation and TMC have also been bought over the last two years.

Executive Jet Management (EJM) has been providing aircraft charter and jet management services since 1977. Overall EJM manages more than 200 aircraft, and saw its charter hours grown 68% in 2021. Parent company NetJets is the largest fractional aircraft company.

XO dropped back into third place, after jumping up a spot to second in 2020. Parent company Vista Global, also owns Vista Jet and has stakes in Red Wing Aviation Company, number 11 on the list of operators above, and in Talon Air, number 17. Overall the group of companies has over 200 aircraft in their global fleet, after adding 30 aircraft in 2021. Vista Global has also been busy buying other private aviation companies and made a recent acquisition in Europe. (after this article was written, Vista also bought Jet Edge, number 7 on the list above. Combining all the recent acquisitions pushes the Vista Group back into the number two spot.)

Jet Linx Aviation has been expanding across the country over the last few years, and now has bases in 20 locations. For a few months at the end of 2021 it had put new jet card sales (under Part 135) on hold, saying current customers were flying 40% more and they want "to safeguard the quality and reliability" of their service. At the start of 2022, Jet Linx resumed card sales on a limited basis.

Exclusive Jets, operates as flyExclusive, and saw its hours grow 75% in 2021 pushing it up into fouth place. Its charter fleet of mainly Cessna Citation jets, has grown to over 75 aircraft, with plans to add more in 2022.

Solairus Aviation was founded in 2009 and is headquartered in the San Francisco Bay Area. In total it manages over 275 aircraft nationwide with over 70 base locations. Some of these aircraft are available for charter and some operate under Part 91.

Jet Edge owns or manages 80+ aircraft which are mainly super-midsize, large cabin and ultra-long range planes. They made significant additions to their fleet in 2021, with new funding from KKR.

Further down the list, Jet It offers both Part 135 charter flights and Part 91k fractional programs. It has been growing rapidly, with a fractional offering in the Honda Jet, and may well appear in the largest fractional aircraft companies for 2022 (rather than in the charter operator list).

ARGUS notes "business aviation particularly in North America, is in full growth mode" adding this is "boosted by the significant amount of new travelers into private aviation." They expect further growth in 2022 , including 4.9% growth in the charter market. We are also expecting continuing consolidation in the operators and managers of charter aircraft.