Figures from ARGUS show the largest part 135 charter operators in the USA in 2020. The figures include both the hours flown and the number of aircraft in their charter fleets. Overall hours in 2020 dropped due to COVID, but at the same time there is a lot of consolidation happening in the industry.

Rankings

The table below shows the twenty five largest charter operators ranked by number of flight hours in 2020.

In many cases the companies also manage additional aircraft that the individual owners do not make available for charter. Most of the larger operators also offer jet card or membership options as well as on-demand charter.

| Operator Name | Hours | Fleet Size |

| Gama Aviation Signature | 65,307 | 165 |

| XO Jet | 50,392 | 56 |

| Executive Jet Management | 37,348 | 132 |

| Jet Linx Aviation | 29,664 | 102 |

| Mountain Aviation | 27,661 | 148 |

| Delta Private Jets | 26,510 | 58 |

| Exclusive Jets | 24,579 | 60 |

| Solairus Aviation | 20,968 | 78 |

| Jet Edge | 19,277 | 59 |

| Travel Management Company | 14,624 | 21 |

| Clay Lacy Aviation | 10,761 | 56 |

| Aero Air | 10,508 | 27 |

| Corporate Flight Management | 10,308 | 23 |

| Talon Air | 9,850 | 32 |

| Worldwide Jet Charter | 9,702 | 13 |

| Red Wing Aeroplane Co | 9,199 | 13 |

| Advanced Air | 7,839 | 22 |

| Jet Aviation | 7,493 | 34 |

| Jet Access Aviation | 6,641 | 29 |

| Superior Transportation Associates | 6,396 | 28 |

| SC Aviation | 6,208 | 15 |

| Jet Select | 6,184 | 23 |

| Berry Aviation | 6,047 | 23 |

| Scott Aviation | 5,998 | 24 |

| Pacific Coast Jet | 5,923 | 15 |

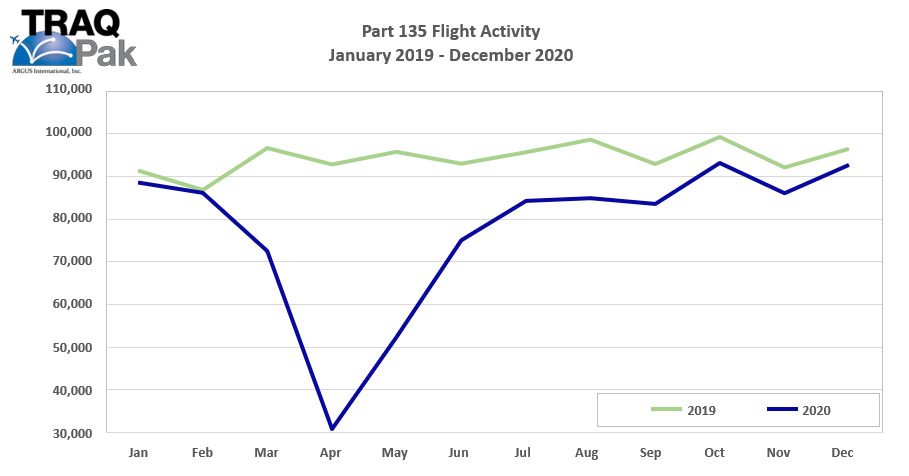

In total, part 135 operators flew 1,329,729 hours in 2020 which is a decrease of 234,941 hours, or 15%, from 2019. The drop was most significant in large cabin aircraft which dropped 28.7% in 2020 due to the COVID restrictions impacting long distance and particularly international flights. In contrast small cabin aircraft only saw a drop in flight hours of 10.3% according to ARGUS.

Monthly Trend

The overall charter flight hours by month followed a very similar pattern to that seen across other parts of private aviation, with a large COVID fall in April and then a steady recovery. The graph below, courtesy of ARGUS, shows the hours by month compared to 2019.

Comments

The top 10 largest operators are the same as 2019, although the order has changed a little.

Gama Aviation Signature, has held the largest part 135 operator title since 2016. The operator was acquired by Wheels Up in 2020, further adding to the list of operators and brands that are now part of the consolidated operator brand.

XO jumped in to second after being third for several years. Helped by parent Vista Global, the operator of mainly super-mid aircraft has increased the number of planes on its part 135 certificate. During 2020, XO also acquired a majority stake in Red Wing Aviation Company (number 16 on the list of operators above), bringing a fleet of light jets into the corporate mix.

Executive Jet Management, a NetJets company, has been providing aircraft charter and jet management services since 1977. Overall EJM manages more than 220 aircraft, some of which are available for charter.

Jet Linx Aviation has been expanding at a steady pace over the last few years as it opens bases across the country. In 2020 it acquired Meridian Air Charter and its fleet of 23 aircraft.

Mountain Aviation and Delta Private Jets were both acquired by Wheels Up over the last two years.

North Carolina based Exclusive Jets, operates as flyExclusive and has grown rapidly over the last few years. Its charter fleet mainly consists of Citation aircraft, although it did add three larger Gulfstream jets in 2020.

Solairus Aviation was founded in 2009 and is headquartered in the San Francisco Bay Area. In total it manages over 220 aircraft nationwide with over 65 base locations.

Jet Edge manages 85+ aircraft which are mainly super-midsize, large cabin and ultra-long range planes. They also have a couple of Boeing Business Jets. In January 2020 they acquired JetSelect Aviation, which operates a large managed fleet of Challenger business jets.

Wheels Up acquired Travel Management Company in 2019, bringing its fleet of Hawker 400XP light jets into the private aviation platform company.

As you can see there has been a lot of consolidation in the operators and managers of charter aircraft.