The latest private flight data shows that overall global private jet activity in Q1 of 2023 was down 4% compared to Q1 2022, but still up 15% compared to (pre-pandemic) Q1 of 2019, according to WingX. This article looks at the split of activity for North America and Europe and between Part 91k fractional, Part 135 charter and Part 91. The North American fractional market is proving the most resilient with flight numbers continuing to increase.

North American Flight Activity

WingX says business jet departures from North America in Q1 2023 were 5% down compared to Q1 2022, but up 13% compared to the same period in 2019.

The one type of usage showing consistent growth is fractional ownership. WingX has this up 6.9% for Q1 compared to the same period in 2022. Fractional operators are also flying 25.3% more than 2021, 34.2% more than 2020 and 32.2% more than pre-pandemic Q1 2019. This continued fractional flight growth has continued into April.

ARGUS TRAQPak data shows that this increase for fractional flights is across all aircraft types from turboprops to large cabin aircraft. The largest increase was recorded in the small cabin fractional jet market, up 12.7% year over year.

There’s ongoing demand for fractional jets, with Patrick Gallagher, President, NetJets Sales, Marketing & Service recently saying “it’s hard to believe that the next available share of a NetJets Phenom in the US arrives Q4 of next year.”

ARGUS also reported the Part 91 market had drops in all 4 aircraft segments (turboprops, light, midsize and large cabin), although turboprops were mostly flat. This segment finished down 4.3% compared to the prior year quarter.

Part 135 activity (charter, including most jet card flights) saw the largest decline down 12.0% in total compared to the first quarter of 2022. Within Part 135, small cabin and midsize flights saw drops of 18.2% and 17.2% respectively according to ARGUS data.

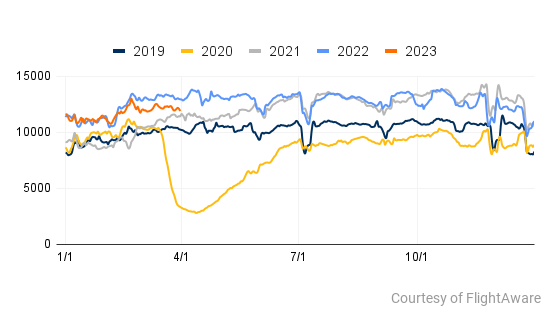

Looking at the business aviation (private flight) trends in just the United States, the graph below, courtesy of Flightaware, shows how the 2023 orange line of activity is trending below the light blue line for 2022 in the first quarter.

Europe Flight Activity

WingX notes that business jet departures from Europe in Q1 2023 were 8% down compared to Q1 2022, but 5% ahead of the comparable period in 2019. The war in Ukraine is having some impact on these numbers, but even excluding Russia (where flights have dropped significantly) the Q1 trend was 5% down compared to 2022, and 9% ahead of 2019. This drop in European private flight activity has continued into April.

Light jets were the busiest aircraft segment in Europe for Q1 of 2023, although departures were down 10% compared to 2022, but still 6% ahead of comparable 2019. WingX says heavy (large cabin) jets, entry level jets and Bizliner departures were behind 2019.

ARGUS also notes a large drop in large cabin jet activity, just looking at the monthly numbers of March 2023 compared to March 2022, the large cabin flights were down 32.7% year over year.

WingX suggests that some of the private aviation flights are replacing commercial traffic. They cite private jet flights from Amsterdam to London airports which are up 80% compared to 2019, whereas the scheduled connections from Amsterdam to London are down 27%. They further point out that 56% of scheduled airline departures were less than 90 minutes in length, but 76% of business jets flew under 90 minutes from Schiphol.