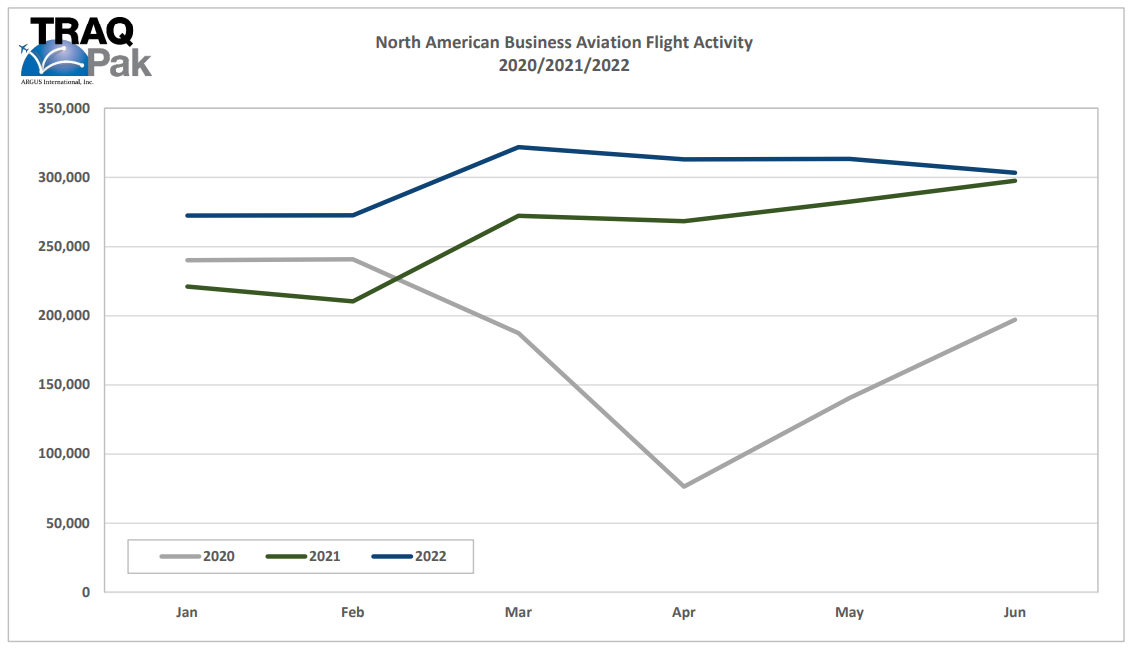

Recent data from ARGUS TRAQPak shows a record setting pace for business aviation in North American and European markets for the first six months of 2022. In North America flight activity was up 15.8% from 2021, while European activity rose 58.3% from 2021 for the first half of the year. There are signs that the pace of growth is cooling.

North America

The TRAQPak analysts note that North American flight activity has consistently exceeded prepandemic levels over the last 12 months. For the first half of 2022 flight activity was up 17.0% from 2019 while flight hours rose 24.0%.

The growth is across all sectors of private aviation including Part 91, Part 135 (charter) and Part 91k (fractional). The large cabin aircraft have seen the largest increase in flights, compared to 2021, as long distance flying really comes back, and other aircraft sizes have all seen demand and flight activity continue to increase.

The graph below shows the North American flight activity per month for the first 6 months of 2022, 2021 and 2020, courtesy of ARGUS:

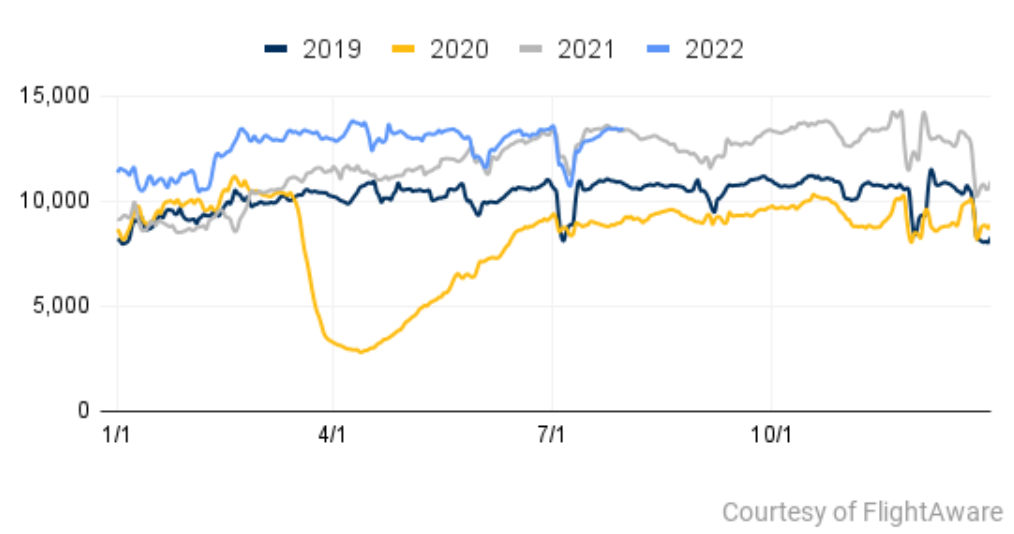

Including the very latest data from FlightAware, which shows the daily level of North American private flight activity, you can see the moderating growth in July 2022 (the light blue line), in the graph below (which tracks the grey line from 2021).

The largest North American Part 135 charter operators in the first 6 months of 2022 are shown in the table below, courtesy of ARGUS:

| Operator | 2022 Hours | 2021 Hours |

| Wheels Up | 82,478 | 82,083 |

| Executive Jet Management | 39,410 | 28,937 |

| Solairus Aviation | 26,437 | 17,712 |

| XO Jet | 23,625 | 29,611 |

| Exclusive Jets | 23,375 | 22,274 |

| Jet Linx | 18,784 | 20,323 |

| Jet Edge | 14,069 | 14,821 |

| Jet Aviation | 9,748 | 4,947 |

| Corporate Flight Management | 9,024 | 6,336 |

| Clay Lacy Aviation | 8,479 | 6,747 |

The list is very similar to the order of largest charter operators in 2021, with Wheels Up being the largest operator in the first half of 2022.

Forecast Rest of 2022

TRAQPak analysts estimate that flight activity from July – December 2022 will increase 1.0% over the same period in 2021 and 19.8% over the same period in 2019. With the current trends 2022 flight activity will finish up 8.5% from 2021, 55.2% from 2020 and 18.2% from 2019.

So even with some cooling of the demand growth, the overall industry is expected by ARGUS to remain 15% - 20% larger in the post-pandemic environment.