Private Jets and Business Aircraft

With the well documented issues in commercial flying more and more people have found reasons to turn to private aircraft.

There are a variety of options to consider. The starting point is how often you want to fly privately.

If you only fly a few hours a year then on demand aircraft charter is probably the best way to go. As your number of hours of private flying increases look at charter cards and fractional cards.

Once you reach about 50 hours of flying a year then fractional aircraft ownership can start to make sense and above 300 or so hours per year whole ownership is worth looking into. Here is some core information to help you understand the options.

All of the major providers have expanded over the last few years. Many now offer a wide range of products and solutions to meet the needs of various clients. If you're looking at the different options and would like a good general overview then download our free Guide to Private Aviation, which includes details on charter, jet cards and fractional ownership. For detailed side by side comparisons of the leading jet card and fractional providers, a directory of charter operators, and our Aircraft Buying Guide then sign up for membership.

The latest news and research on private jets and aircraft is included below.

- Details

- Written by Nick Copley

The feud between the Elon Musk and the student Jack Sweeney, has received a lot of publicity. Sweeney runs various @elonjet social media accounts, that report on the flights and locations of Elon Musk’s Gulfstream jet. Sweeney also tracks other celebrity aircraft. So, what are the options for Elon Musk or anyone else who doesn’t want to be tracked while flying in a private jet?

- Details

- Written by Susan Kime

One of the leading innovators in the private aviation sector, and the originator of the jet card, Sentient Jet is forecasting revenues of $460m for 2022. Helping this growth is the trend towards more digital reservations, that the company is seeing as it rolls out more booking options for clients. SherpaReport talked to Andrew Collins, CEO of Sentient Jet about this growth and these recent trends.

- Details

- Written by Nick Copley

Four Corners Aviation offers a novel program for companies that fly over 200 hours a year and want access to a corporate aircraft. The program really works for organizations that recognize the value of private aviation but that don’t want the upfront capital expenditure of owning an aircraft, or want to keep a plane off the corporate balance sheet. It offers the financial surety of a fixed monthly fee, rather than varying monthly expense costs.

- Details

- Written by Nick Copley

Fractional jet and jet card provider Volato has ordered another 25 HondaJets. This new order will bring the total fleet to over 40 of these light jets. The new order is for the latest HondaJet Elite II.

- Details

- Written by Nick Copley

NetJets, the largest private aviation company, is the fleet launch customer for Bombardier’s Global 8000 jet, with a firm order for four aircraft and conversion of eight existing orders.

The new firm order for four Global 8000 aircraft is valued at $312 million dollars based on 2022 list prices.

- Details

- Written by Fiona Young-Brown

As 2022 draws to an end, aviation companies are once again releasing their industry forecasts for sales of new business aircraft. We look at insights from manufacturer Honeywell and analysts at JETNET iQ to see how ongoing economic, social, and political factors may play a part in the market for new business jets.

- Details

- Written by Nick Copley

Kansas City based private aviation operator Airshare has seen significant growth over the last few years. It is phasing out the smaller Phenom 100s, adding super-mid Challenger 350s and increasing its managed fleet. SherpaReport spoke to CEO John Owen about all the developments.

- Details

- Written by Nick Copley

The recent numbers from across the market show continuing high demand for pre-owned business aircraft. General demand, including new buyers, plus the 100% bonus depreciation, which ends this year, is keeping the market very active as 2022 closes out. Prices are generally at historically high levels.

- Details

- Written by Nick Copley

One of the largest private aviation companies in the world, Wheels Up, just announced its results for the third quarter. Revenue increased 39% year-over-year to $420 million, making $1,171 million for the year to date. The number of active members grew 12% to 12,688.

- Details

- Written by Fiona Young-Brown

Two family-owned private aviation management companies have joined forces to pool resources while retaining their dedication to personal service. Chicago-based Priester Aviation announced that they will be merging with Mayo Aviation, which is headquartered in Colorado.

- Details

- Written by Nick Copley

The young jet card and fractional operator plans to add the super-mid Gulfstream G280 to its growing fleet of HondaJets. First deliveries for the G280 will be in 2024.

- Details

- Written by Susan Kime

Semi-private and shared air travel has been making headlines this year, as this idea has expanded across operators. A prime example is XO, a large private aviation company, which has announced an expansion of its most in-demand route between New York and South Florida, providing greater access to their shared flight options.

- Details

- Written by Nick Copley

VistaJet has launched a new membership solution offering a three-year subscription for travelers flying 25 to 49 hours per year, as opposed to VistaJet’s 50+ hour per year commitment in its Program membership. Parent company Vista Global Holding announced sales in the US jumped 185% in the first nine months of 2022 over the same period in 2021.

- Details

- Written by Nick Copley

Textron Aviation, manufacturer of Cessna business jets, announced it has entered into a purchase agreement with Exclusive Jets, LLC, operating as flyExclusive, for up to 14 additional Cessna Citation aircraft. This new order will grow the flyExclusive fractional jet program, and follows on the news that flyExclusive will be going public via a SPAC.

- Details

- Written by Nick Copley

The largest private aviation company is restarting sales of its 25-hour jet card. But new sales are limited to existing owners.

- Details

- Written by Nick Copley

Another large private aviation company, flyExclusive has just announced plans to become a public company. The rapidly growing charter operator is planning to merge with EG Acquisition Corp. (NYSE:EGGF) and be listed on the NYSE.

- Details

- Written by Nick Copley

The new SherpaReport Aircraft Buying Guide is geared towards people looking to buy larger turboprop and jet aircraft, as well as those exploring the idea of acquiring their first piston plane. The detailed book provides comprehensive guidance on all aspects of purchasing a private aircraft.

- Details

- Written by Nick Copley

One of the world’s largest private aviation companies is becoming publicly traded in a SPAC deal. Fractional jet provider Flexjet, together with its fellow brands Sentient Jet, FX Air and Private Fly will be merging with the special purpose acquisition company Horizon Acquisition Corp II (ticker: HZON). The transaction implies a pro forma enterprise value for Flexjet of approximately $3.1 billion. (Editorial update: As of 11th April 2023, Flexjet and Horizon have called off their deal and Flexjet is no longer planning to go public.)

- Details

- Written by Susan Kime

One would assume the world of private aircraft defines a kind of stability – but to those who look at the creation and evolution of the jet card, the fractional jet, and leasing, the blue-sky world is ever-evolving, sensitive to the changes in the world below.

NetJets, for example, has recently announced that it is once again welcoming new clients with a new NetJets 25-Hour Lease option, built for travelers who fly 25 hours or more per year. This has been available since earlier this year, to existing NetJets owners and those forbearing people who were on the NetJets wait list. But recently the NetJets 25-Hour Lease has been opened up for those outside the wait list.

- Details

- Written by Nick Copley

Private aviation solution provider XO has reduced the number of membership tiers that it offers and no longer offers a fixed hourly rate, jet card type product. Flights booked under the new, single-level XO Membership are all dynamically priced ie are market based.

- Details

- Written by Susan Kime

The lifeline of any high-end luxury business is how well guest services are both offered and conducted. Service for any affluent population is about quiet, unobtrusive, anticipatory service - the norm in any high-end private home or estate.

But on a private jet, exceptional customer service takes on a distinctive face as it has temporal boundaries: limited time, space restraints, and possible weather issues. This makes customer wellbeing in the private jet industry more complex yet more needful than in other hospitality sectors.

As private jet executives consider the post-pandemic journey as a whole, their thoughts are to make the customer feel the greatest degree of comfort, that include feeling safe, cared for, attended to, so that both want and need of the traveler are realized and valued. This is accomplished in a variety of ways.

- Details

- Written by Nick Copley

SherpaReport recently visited the headquarters of fractional aircraft operator PlaneSense. The tour included an overview of the flight operations, maintenance, pilot training and customer service areas.

Latest Aviation Research

- Updated Aircraft Buying Guide

- What are FBOs And What Services Do They Provide

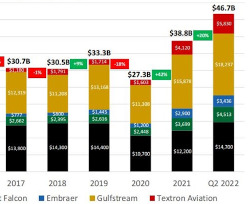

- The Largest Fractional Aircraft Operators in 2022

- New Guide to Buying a Private Aircraft

- Used Business Jet Sales Are Surging

- Chartering a Private Aircraft: Primer for First Time Buyers

- Negotiating Fractional Jet Contract Terms

- An Introduction to Flying on Private Aircraft

- New Business Jet Sales Up in 2018

- Buying a Jet for Charter Revenue